What are you Looking for?

Select Sidearea

Populate the sidearea with useful widgets. It’s simple to add images, categories, latest post, social media icon links, tag clouds, and more.

Contact info

-

P: Phone:

-

E: Email:

-

A: Address:

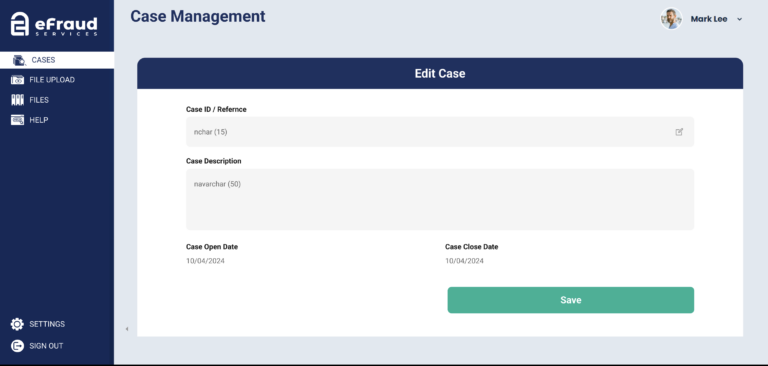

FraudShield SaaS: Smart Document Analysis & Fraud Prevention

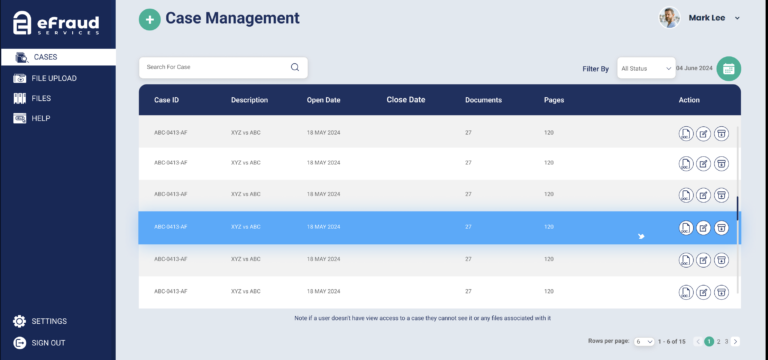

Designed for government and enterprise clients, eFraud transforms the way financial documents are analyzed, turning complex data into actionable insights.

Our team took ownership of the entire development process, from architecture to deployment, ensuring a seamless and intuitive experience for users. The result? A powerful, cloud-based solution that detects fraudulent activities in uploaded PDF documents—think bank statements, credit card records, and more—by leveraging AI-driven processing and real-time error correction.

What We Built

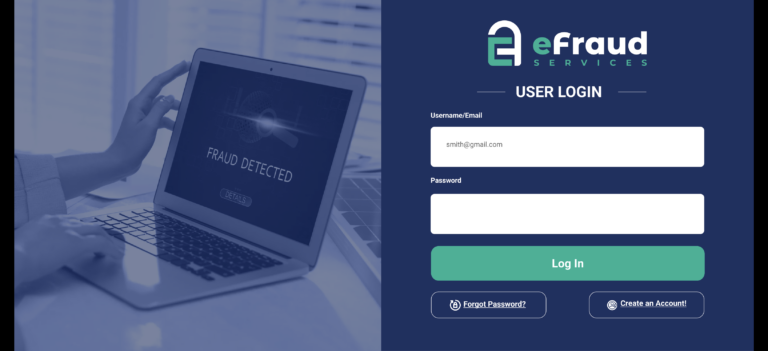

🔐 Enterprise-Grade Authentication

We implemented a secure authentication system tailored for high-level business and government users, with support for primary and secondary user roles. Security is at the core of this platform, ensuring compliance with industry standards.

📊 Advanced BI & Reporting with Yurbi

A fraud detection tool is only as good as its insights. We integrated Yurbi, a powerful business intelligence platform, embedding custom dashboards directly within eFraud. Our API connections ensured seamless data flow, giving users real-time analytics and fraud risk assessments at their fingertips.

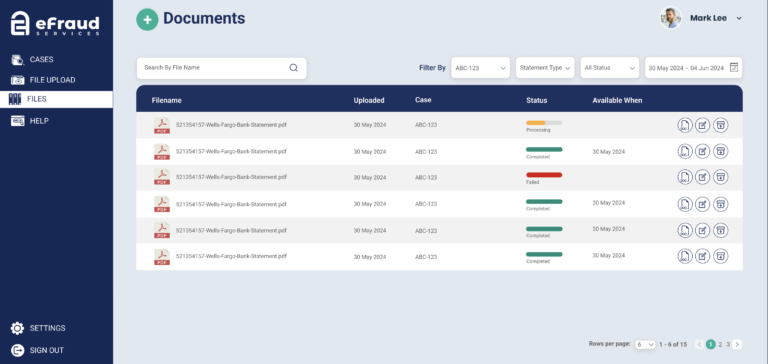

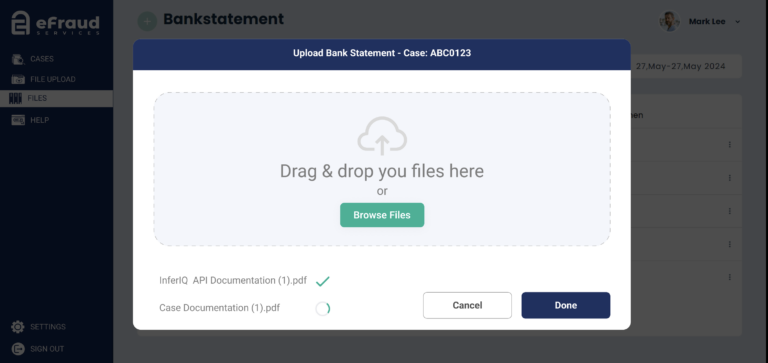

📂 PDF Upload & AI Processing

eFraud enables users to upload financial documents, which are then processed through Idexcel’s InferIQ APIs. Our system extracts, structures, and cleans the data, converting messy PDFs into machine-readable JSON outputs for deep fraud analysis.

🗄️ Scalable Database & Cloud Infrastructure

We architected a robust AWS-hosted MySQL database to store user data, processed documents, and extracted transaction records. Every table was optimized to support scalability, ensuring high availability and performance.

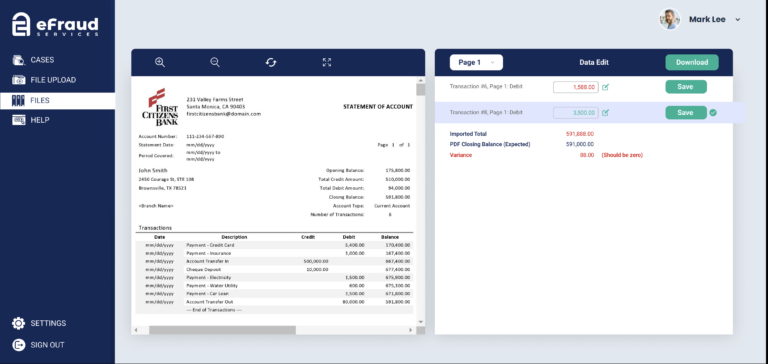

🛠️ Human-in-the-Loop (HIL) Error Correction

Because even AI needs a human touch, we built an interactive UI that allows users to review and correct OCR errors. With a split-screen view—original PDF on one side, structured transaction data on the other—users can validate, edit, and approve extracted data before it moves into analysis.

🛠️ Human-in-the-Loop (HIL) Error Correction

Because even AI needs a human touch, we built an interactive UI that allows users to review and correct OCR errors. With a split-screen view—original PDF on one side, structured transaction data on the other—users can validate, edit, and approve extracted data before it moves into analysis.

🎨 User-Centric UI/UX

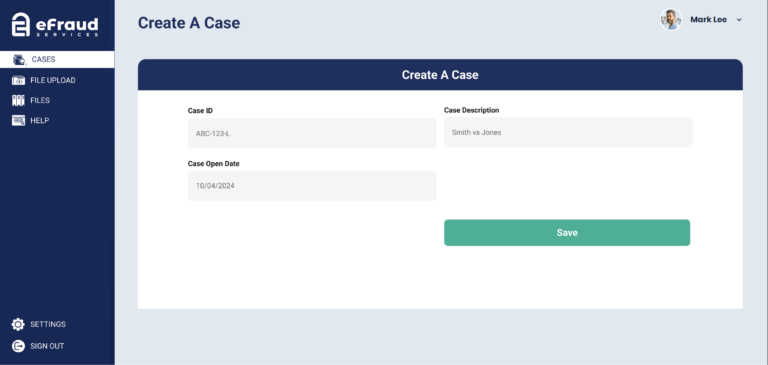

Our frontend team designed and built a sleek, intuitive web app using React. Inspired by Figma prototypes, we ensured every feature—from document uploads to fraud analysis dashboards—was easy to navigate and visually compelling.

Active Users

57

ROI %

225

Tech Stack That Makes It All Happen:

- Frontend: React, Figma

- Backend: Node.js, Express.js

- Database: MySQL, AWS RDS

- Cloud Services: AWS (EC2, S3, RDS)

- APIs: Idexcel (InferIQ), Yurbi

- Version Control: GitHub

- Project Management: Trello, Microsoft Planner

- Tools We Loved: Postman (for API testing), Loom (for client updates), Dialpad (for meetings)

Development Journey

Project Inception & Ideation

- Conducted initial strategy meetings with stakeholders.

- Defined core functionalities: User Authentication, PDF Processing, Fraud Detection, Reporting System.

- Created a high-level roadmap and development timeline. 🛠️

Architecture & UI/UX Design Begins 💻

- Designed system architecture using React for frontend and Node.js for backend.

- Wireframed and prototyped the document processing UI and reporting dashboard.

- Planned AWS cloud infrastructure for hosting, storage, and database management. 💻

Core Development Begins 🛠️

- Implemented secure user authentication and role-based access control.

- Started backend API development for PDF uploads and fraud analysis.

- Set up MySQL database for storing transaction data and user activities. 🚦

PDF Processing & OCR Integration

- Integrated Idexcel (InferIQ) APIs to handle PDF uploads and data extraction.

- Developed error correction UI for manual adjustments to OCR-processed transactions.

- Established API calls for document processing and polling mechanisms. 📜

Fraud Detection Engine MVP Completed

- Built the fraud detection algorithm to identify suspicious patterns in transactions.

- Implemented confidence scoring for OCR-extracted data.

- Developed an alert system to notify users of potential fraudulent activities.

Reporting & Dashboard Integration

- Integrated Yurbi BI tool to generate fraud analysis reports and insights.

- Embedded Yurbi dashboards into the application for real-time analytics.

- Created API endpoints to fetch and display customized user reports. 📊

Performance & Security Enhancements

- Optimized vector search queries to improve response times.

- Implemented asynchronous processing for faster document ingestion.

- Explored Dockerization for cross-platform compatibility.

- Addressed ONNX dependency errors and streamlined model execution. 🏗️

Beta Testing & Iteration

- Launched a beta version with select government and business users.

- Collected feedback on UI, fraud detection accuracy, and report generation.

- Identified and fixed bugs, performance bottlenecks. 🧪

Public Rollout Preparation

- Finalized UI enhancements based on beta feedback.

- Completed last security reviews and compliance checks.

- Began onboarding new business and government clients. 🚀

Official Public Launch

- eFraud Platform goes live with all core features fully functional.

- Marketing and outreach to onboard more users.

- Continuous monitoring for stability, security, and feature adoption. 📈